References are made wherever possible. All statements are based on the author’s experiences. I take pride in informing the public and helping as many as I can through sharing my experiences with my readers. That said, no one except you can take responsibility for your Cryptocurrency Investing decisions, so do think it through before investing.

It would be appropriate to start this guide off with the premise that an increasing number of e-commerce stores are beginning to accept crypto currency payments. These stores range from e-commerce shops, recruitment sites, clothing stores, marketplaces and many others. This is a clear indicator that cryptocurrency is to stay and it is therefore important to start from the beginning.

When I first started taking an interest in cryptocurrency I thought I was so lost in this huge sea of unknowns. Where do I start? What are the useful keywords to look up and keep in mind? What are the available helpful resources? This cryptocurrency investing guide is written so that in just 20 minutes, you would have a sense of what to expect of your upcoming crypto journey, and how to best go about starting it. Enjoy it, it might just be the most exhilarating ride of your life.

Beginner’s Guide to Cryptocurrency Investing

Rise of the Cryptocurrencies

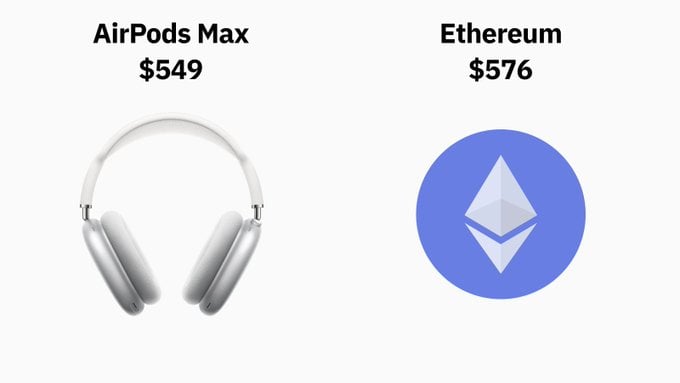

As the tech literacy of the population increases, acceptance of crypto as a legitimate store of value follows, and it boomed. Titles along the lines of ‘Bitcoin price hits new all-time high’ and ‘Ethereum price surges’ are starting to perforate the general public’s news feed. What we know for sure is that people who were once sceptical of Bitcoin and the technology behind it are slowly understanding and getting increasingly involved with crypto. As at the time of writing, the market cap of the entire crypto space is at 30.9 billion USD. It was 20 billion just four months ago. What would it be four months from now?

Current Makeup of the Cryptocurrency Space

You would have heard of Bitcoin and the ‘altcoins.’ How this naming convention started was because back in the days of 2011, forks of Bitcoin appeared in the markets. The forks, or clones, each aspire to serve a niche area, aiming to be ‘better’ than Bitcoin. Since then countless new crypto has emerged, eroding away Bitcoin’s crypto market cap dominance. These altcoins are gaining market share at an alarming speed. Ten times or more growth has been observed in a time span as short as six weeks (see PIVX, an altcoin).

Cryptocurrency, Stocks, and Fiat

The currencies we know are referred to as ‘fiat’ by the cryptocurrency community. Although having ‘currency’ in its name, cryptocurrencies share more similarities with stocks than currencies. When you purchase some cryptocurrency, you are in fact buying some tech stock, a part of the blockchain and a piece of the network.

Cryptocurrency Exchanges

The most common place where people buy and trade cryptocurrency is on the exchanges. Exchanges are places where you may buy and sell your crypto, using fiat. There are multiple measures to judge the reliability and quality of an exchange, such as liquidity, spread, fees, purchase and withdrawal limits, trading volume, security, insurance, user-friendliness. Out of all these, I find Coinbase as the best exchange hands down. It has a beginner-friendly user interface, and an unbeatable 100% crypto insurance.

After setting up an intermediary bank account and verifying your details with Coinbase, you are only five simple steps away from a Bitcoin purchase:

★ Access the ‘Buy/Sell Bitcoin’ tab

★ Select the payment method using the drop-down menu

★ Enter the desired amount

★ Click ‘Buy Bitcoin Instantly.’

★ View your credited Bitcoins on your dashboard

When you get acquainted with buying crypto and start to itch for some crypto trading (e.g. BTC/ETH), simply perform an instant transfer from Coinbase to GDAX free of charge and start trading. Think of Coinbase as the place to conveniently buy and store your crypto and GDAX as your margin trading platform. Transfers between the two are instant and free.

As you slowly get familiar with other currencies, you might want to have the option of investing in them. Bittrex and Polo are two exchanges that offer a wide selection range.

When signing up on these exchanges for the first time, do make it a point to verify your account with the required documents early, as you do not want to be caught in the middle of some tedious and slow admin work when the trading opportunity comes. Verification on these exchanges may take days, and purchase/withdraw limits may only increase gradually as you trade.

An additional point to note: if you are using a currency other than USD, do check out the exchange’s ease of funding and withdrawal. You do not want your exchange to come into fiat withdrawal problems like Bitfinex did recently.

Cryptocurrency Wallets

Exchanges have inbuilt online wallets to keep the cryptocurrency you purchased. However, for those who heard of the Mt. Gox hack, you might feel uneasy to put on an exchange. If you do not wish to keep your crypto holdings on the exchange, you have the option to either use a paper wallet service like myetherwallet.com or spend 99 USD on a hardware wallet like KeepKey. Both serve the purpose of removing platform risk, at the cost of taking up the responsibility of keeping your cryptocurrency safe.

To transfer your crypto from exchanges to your hardware wallet for long term storage, simply follow these steps, using Coinbase and KeepKey as an example:

★ Plug in your KeepKey USB cable

★ Open your KeepKey Client (on Google Chrome under Apps)

★ Find your wallet address on the KeepKey Client UI

★ Access Coinbase ‘Send/Request’ tab and input your KeepKey wallet address

★ Confirm amount and click ‘Send Funds’

Take note to first send a tiny amount (e.g. 0.0001 BTC) for testing before sending the bulk, lest an error occurred and the transfer amount is lost. A small network transfer fee might be charged.

Personally, I own a hardware wallet, as I love the feeling of a having around a tangible reminder of my crypto holdings. Also, the hardware wallet’s user interface makes it easy to keep multiple coins, which is especially handy when you participate in ICOs (Initial Coin Offering) in the future.

Cryptocurrency as a Percentage of Your Portfolio

This part will be wildly subjective. Crypto has the potential to realize many ‘rags to riches’ stories, but its volatility makes it unpredictable. As a precaution, the money you put in crypto should be money that you are fine with losing. I cannot emphasize the importance of this as we often underestimate how the volatility affects our emotional capacities. The upside is huge, but it comes with lots of risks and, if I may put it, emotional torment.

A conservative portfolio I would suggest is as follows:

★ < 30 years old (max) 30% Crypto, 50% Traditional Investments

★ 30 – 40 years old (max) 20% Crypto, 60% Traditional Investments

★ > 40 years old (max) 10% Crypto, 70% Traditional Investments

This is not meant to be age discriminatory but considers the fact that one takes up more financial responsibilities (mortgage, family) as he grows older.

Within the designated crypto share of your portfolio, you may diversify your coins based on your risk appetite.

Show Me the Money! Cryptocurrency Investing

Now, this is where it gets exciting.

How do we pick the winner? How do we avoid picking the loser?

Note that crypto is now in a huge bull market and anything could rise over time. Also, do not dismiss the possibility that we may be in a bubble like the-dot-com boom back in 2000. Still, ask yourself these questions before you decide to invest in a coin:

Are my investments safe with the dev team? The first rule of investing should always be the preservation of capital. Can you trust the dev team with your money? Are you about to leave your money with founders who have been involved in previous scams? If you see these telling signs, back off immediately. The coin’s price might grow for all you care, but it is just not worth it to put your capital at such risk.

Does my coin of interest have a long-term plan? If you cannot understand their yellow paper, at least read their white paper. What are the team trying to achieve? Do they have the means, or have they already worked towards their goals? What are the timelines and milestones?

Does my coin of interest seem like a well-marketed plan with no backup? Lots of ICOs these days just have a pretty webpage, and then they’re shipped out to sell. Watch out for these: are they able to deliver?

How long should I stay in this? Do I have an exit plan? There will be coins where you do not want to hold forever, but wish to flip for some short-term gains. In this case, be sure to set a timeframe, or an exit price, to reduce to effect of emotions on your trades. Stick to your plan and watch your emotions.

Does it have a real-world use case? Some coins seem to keep increasing in value simply due to supply-demand factors. This trend might not be sustainable. For a coin to have long term supported value, it must have a real-world use case eventually. Look out for coins that look too much like a get-rich-quick scheme.

Short Term Trading with Margin

Once you get familiarized with crypto, you may want to trade on your ‘stash’ in hopes of increasing it. For the experienced forex traders, this is nothing new. But for the new crypto investor, you may want to brief up on how to make a leveraged trade.

Short-term trading takes advantages of incoming news to make a quick buck. If you foresee good news from an upcoming release of a coin, you may want to open a long and see how it goes. Remember, buy the rumor, sell the news; act fast and be daring if you wish to make a profit with short term trading.

Mining

For those who are more comfortable with a predictable form of reward, mining is the way. Mining involves setting up of a rig, consisting of GPUs or CPUs and an investment in the electricity. Mining is only possible on cryptocurrencies that follow the Proof of Work protocol. It takes some effort to setup and gets things running, but it is attractive as a long-term passive income as long as you frontload the work.

Staking

Staking is the Proof of Stake version of ‘mining.’ Think of this as making dividends on your stock. The reward rate and staking method differ greatly among Proof of Stake coins, but in general, it takes less effort as compared to mining.

Arbitraging

As you get a hand in multiple exchanges, you may wish to buy from one exchange and sell on another to make ‘arbitrage’ gains when you spot an arbitraging opportunity. Take note of two things if you wish to do so: remember to factor in fees, and remember that the price could change when you are transferring your coin between exchanges, especially during volatile times. USD tends to be liquid so this happens less for it, but for other currencies such as CAD (Canadian dollar) and SGD (Singapore dollar), there may exist more arbitraging opportunities to exploit.

Helpful Resources

Check out coinmarketcap for the tabulation of various coins’ market cap and price. Check out cryptowat for the prices of popular coins across different exchanges. Check out the respective coins’ subreddits for available news and market sentiments. Lastly, check out hypecoaster for how much more crypto you need for a Lamborghini Aventador 🙂

—————–

That’s about all I have, for now, invest smart and most importantly, don’t forget to have fun!