If you run a small business, you know how important it is to have a reliable and easy-to-use invoicing software. Invoicing software helps you create and send invoices, track payments, manage your cash flow, and more. But with so many options available, how do you choose the best one for your needs?

In this blog post, we will review some of the best invoicing software for small business billing. We will compare their key features, pros and cons, pricing, and overall impression. By the end of this post, you should have a clear idea of which invoicing software is right for you. Here are the invoicing software we will cover:

Zoho Invoice

A Powerful and Affordable Invoicing Solution

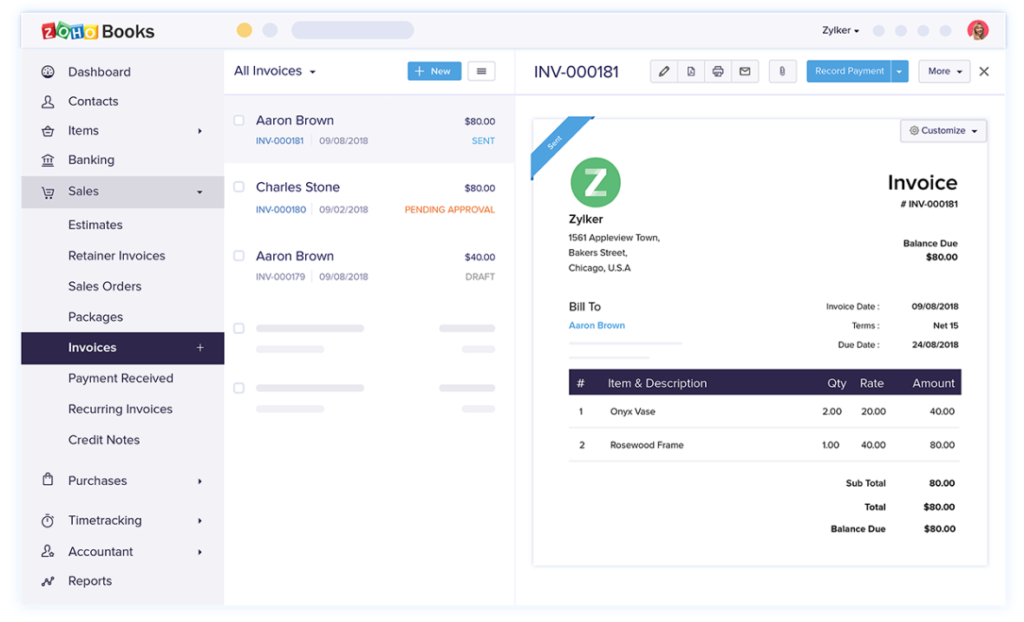

If you are looking for a simple and effective way to create and manage invoices, Zoho Invoice might be the right choice for you. Zoho Invoice is a cloud-based invoicing software that helps you create professional invoices, track payments, send reminders, and automate recurring billing. In this post, we will review some of the key features, pros and cons, pricing and overall impression of Zoho Invoice.

Key Features:

- Customizable invoice templates: You can choose from a variety of invoice templates or create your own with your logo, colors, and fonts. You can also add custom fields, attachments, notes, and terms and conditions to your invoices.

- Online payment options: You can accept payments from your customers via credit cards, PayPal, Stripe, Authorize.Net, and other popular payment gateways. You can also enable partial payments, advance payments, and refunds.

- Time tracking and expense management: You can track the time spent on projects and tasks and bill your clients accordingly. You can also record and categorize your expenses and attach receipts to your invoices.

- Recurring invoices and subscriptions: You can create recurring invoices and subscriptions for your regular customers and automate the billing process. You can also set up reminders and thank-you notes to ensure timely payments.

- Reports and analytics: You can generate various reports and insights on your invoicing performance, such as income and expense reports, tax reports, aging reports, payment history, and more. You can also export your data to Excel or PDF formats.

Pros:

- Easy to use: Zoho Invoice has a user-friendly interface that makes it easy to create and manage invoices. You can also access your data from any device with an internet connection.

- Affordable: Zoho Invoice offers a free plan for up to 5 customers and 1 user. The paid plans start from $9 per month for up to 50 customers and 3 users. You can also get a 14-day free trial to test the features before you buy.

- Integrations: Zoho Invoice integrates with other Zoho products, such as Zoho CRM, Zoho Books, Zoho Projects, and Zoho Inventory. It also integrates with third-party apps, such as Google Workspace, Zapier, Slack, Mailchimp, and more.

- Support: Zoho Invoice provides 24/7 email and phone support, as well as online help guides, videos, webinars, and forums.

Cons:

- Limited customization: Zoho Invoice does not allow you to customize the layout or design of your invoices beyond the templates provided. You also cannot add custom fields or calculations to your invoices.

- Limited automation: Zoho Invoice does not support advanced automation features, such as workflows, triggers, or actions. You also cannot automate the creation of estimates or quotes from your invoices.

- Limited tax options: Zoho Invoice does not support multiple tax rates or tax groups. You also cannot apply taxes based on the location of your customers or products.

Pricing:

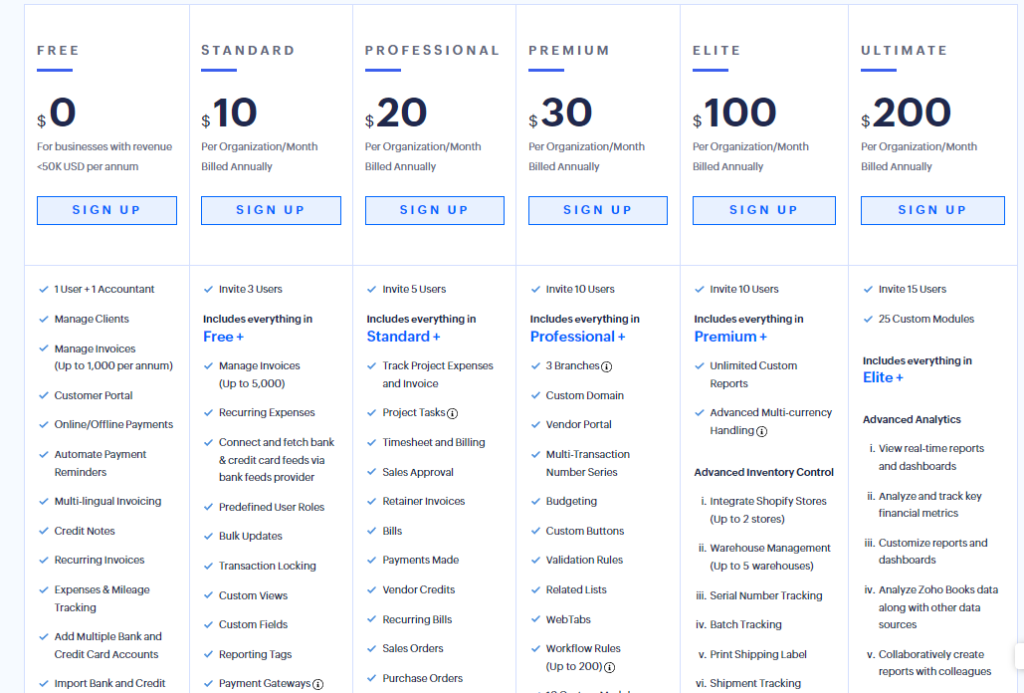

Zoho Invoice offers six pricing plans:

- Free: $0 per month for up to 5 customers and 1 user

- Standard: $10 per month for up to 50 customers and 3 users

- Professional: $20 per month for up to 500 customers and 5 users

- Premium $30 per month for unlimited customers and 10 users

- Elite $100 per month for unlimited customers and 10 users

- Ultimate $200 per month for unlimited customers and 15 users

Overall Impression:

Zoho Invoice is a powerful and affordable invoicing solution that can help you create and manage invoices with ease. It has a range of features that can suit the needs of small businesses and freelancers. However, it may not be the best option for larger businesses or those who need more customization or automation options. If you are looking for a simple and effective way to invoice your customers online, you should give Zoho Invoice a try.

FreshBooks

FreshBooks is one of the most popular invoicing software for small businesses. It helps you create and send professional invoices in minutes. You can also track your time, expenses, projects, estimates, and payments.

FreshBooks integrates with over 200 apps and services, such as PayPal, Stripe, Shopify, Mailchimp, Slack, and more. You can sync your data across devices and platforms, and access your account from anywhere. You can also collaborate with your team members and clients on projects and invoices.

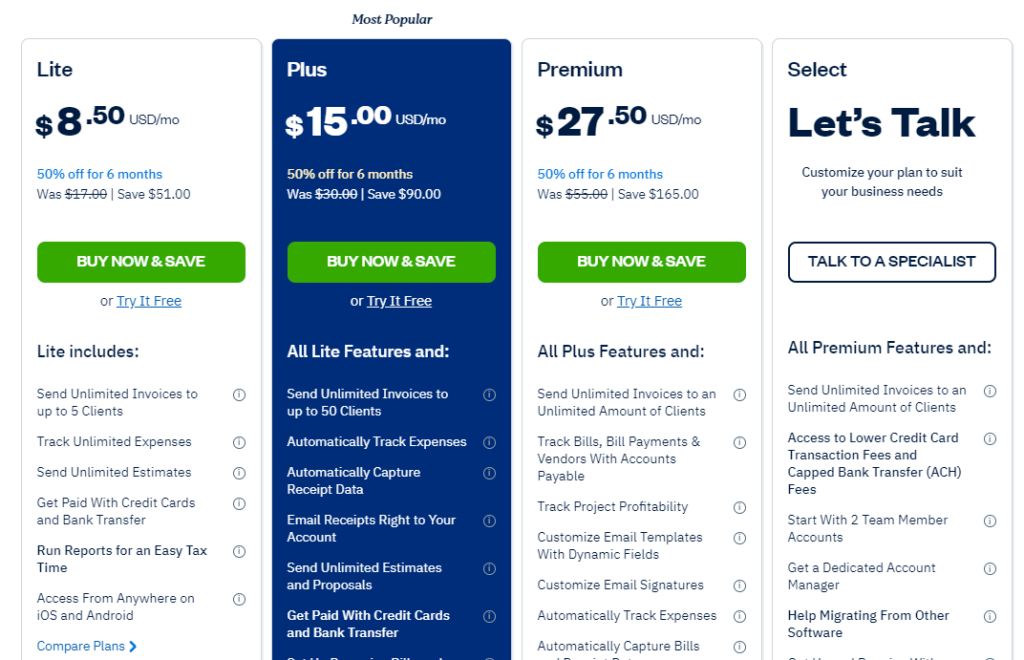

FreshBooks offers a 30-day free trial for all its plans. The paid plans start from $15 per month and vary based on the number of clients you can bill. All plans include unlimited invoices, estimates, time tracking, expenses, projects, reports, and support.

Pros:

- Easy to use and intuitive interface

- Professional and customizable invoices

- Time tracking and project management features

- Multiple app integrations and collaboration tools

Cons:

- Pricing is based on the number of clients

- Some features are only available on higher plans

Pricing:

- Lite: $8.5 per month for up to 5 clients

- Plus: $15 per month for up to 50 clients

- Premium: $27.5 per month for up to 500 clients

- Select: Custom pricing for over 500 clients

Overall impression:

FreshBooks is a user-friendly and reliable invoicing software that suits most small businesses. It has a lot of features and integrations that make invoicing easy and efficient. However, it can get expensive if you have a lot of clients or need advanced features.

Invoice Ninja

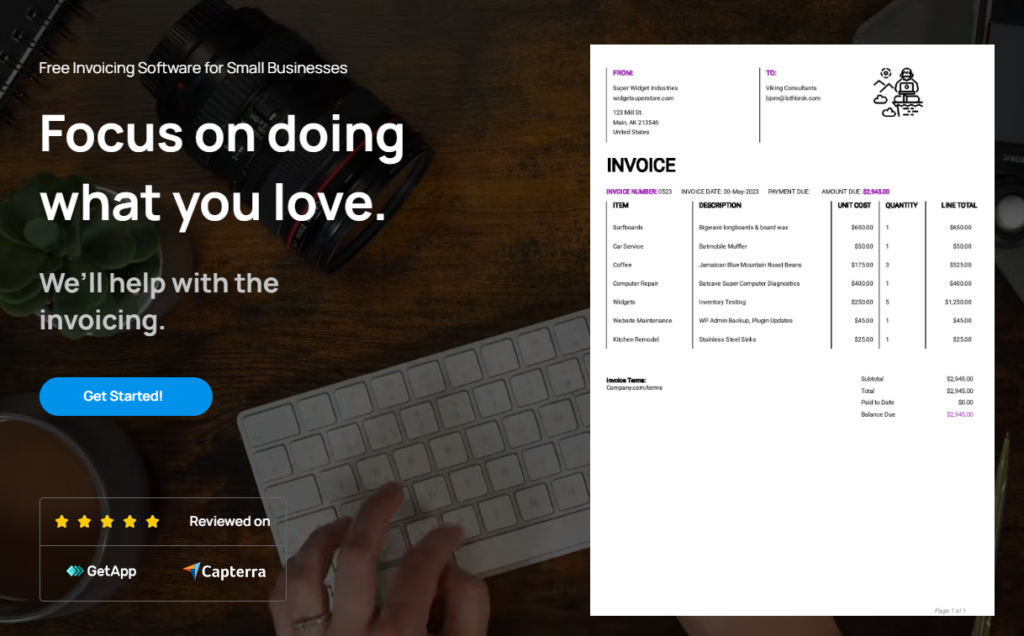

Invoice Ninja is a powerful and flexible invoicing software that lets you create and send invoices, quotes, proposals, and more. You can customize your invoices with your logo, colors, fonts, and payment options. You can also automate recurring invoices, reminders, and thank-you notes.

Invoice Ninja integrates with over 40 payment gateways, including PayPal, Stripe, Authorize.Net, and Square. You can accept payments online or in person, and track them in real-time. You can also manage your expenses, projects, tasks, time tracking, and reports.

Invoice Ninja offers a free plan for up to 100 clients and unlimited invoices. The paid plans start from $10 per month and offer more features, such as custom invoice designs, white-labeling, client portal, and priority support.

Pros:

- Free plan available

- Customizable and professional invoices

- Multiple payment options and integrations

- Expense and project management features

Cons:

- Learning curve may be steep for some users

- Some features are only available on paid plans

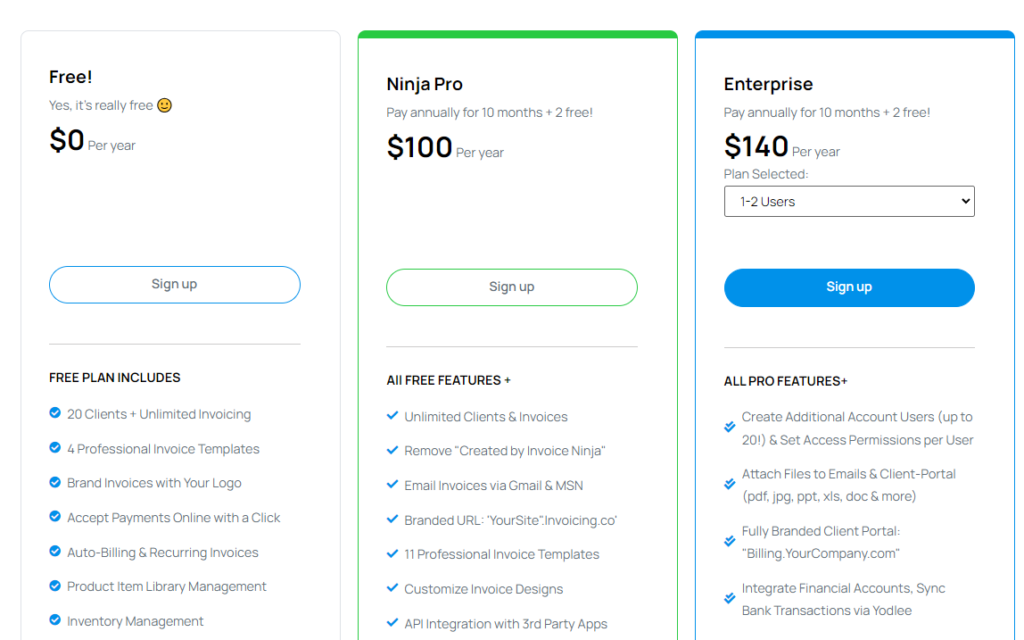

Pricing:

- Free: $0 per year for up to 100 clients and unlimited invoices

- Pro: $100 per year for up to 10 users and unlimited clients and invoices

- Enterprise: $140 per year for up to 20 users and unlimited clients and invoices

Overall impression:

Invoice Ninja is a great choice for small businesses that need a versatile and feature-rich invoicing software. It offers a lot of customization and automation options, as well as integrations with popular payment gateways. However, it may take some time to get used to its interface and functionality.

Wave

If you are looking for a simple and affordable way to create and send invoices, track payments, and manage your finances, you might want to consider Wave Invoicing Software. Wave is a cloud-based accounting software that offers a free plan for freelancers and small businesses, as well as paid plans for more advanced features. In this post, I will review Wave Invoicing Software, including its key features, pros and cons, pricing, and overall impression.

Key Features

Wave Invoicing Software has a number of features that make it easy to create and send professional invoices, such as:

- Customizable invoice templates that you can brand with your logo, colors, and fonts

- Automatic reminders and receipts for your clients

- Recurring billing and subscription options for regular customers

- Multiple payment methods, including credit cards, bank transfers, PayPal, and cash

- Integration with Wave Accounting, Wave Receipts, and Wave Payroll for seamless bookkeeping

- Mobile app that lets you create and send invoices on the go

- Reports and dashboards that show you your income, expenses, taxes, and cash flow

Pros and Cons

Wave Invoicing Software has many advantages, but also some drawbacks. Here are some of the pros and cons of using Wave:

Pros:

- It’s free for unlimited invoicing and unlimited customers

- It’s easy to use and has a user-friendly interface

- It’s cloud-based and accessible from any device

- It’s secure and compliant with PCI-DSS standards

- It has excellent customer support via email, chat, and phone

Cons:

- It charges a transaction fee of 2.9% + 30¢ for credit card payments and 1% for bank transfers

- It doesn’t have some advanced features like inventory management, time tracking, or project management

- It doesn’t integrate with many third-party apps or platforms

- It’s only available in 14 countries (US, Canada, UK, Ireland, Australia, New Zealand, Singapore, South Africa, France, Germany, Spain, Italy, Netherlands, Belgium)

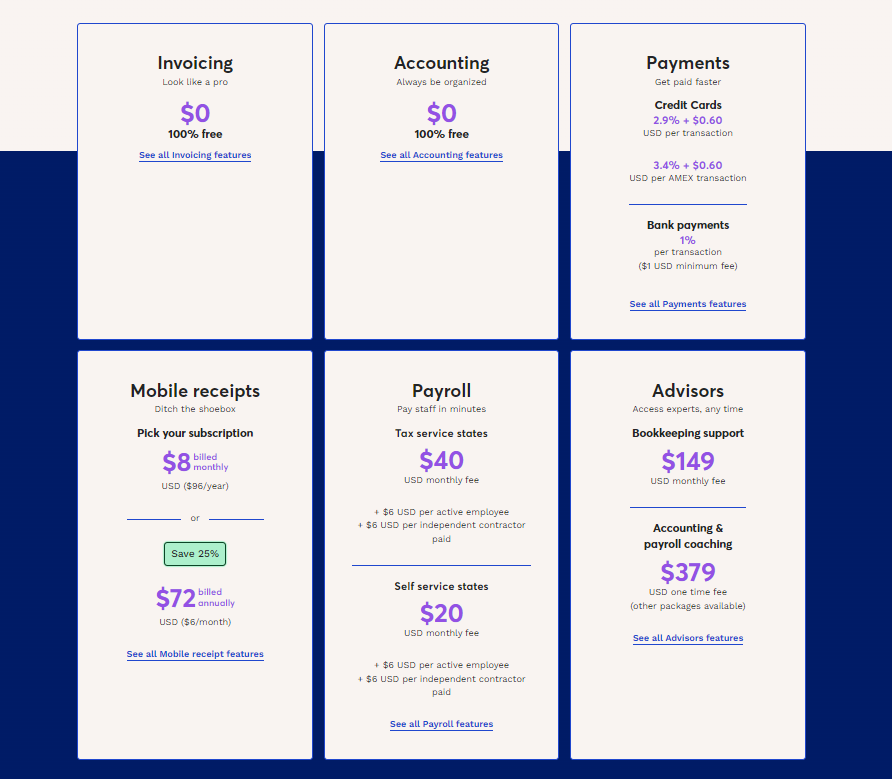

Pricing

Wave Invoicing Software is free to use for unlimited invoicing and unlimited customers. However, if you want to accept online payments from your clients, you will have to pay a transaction fee of 2.9% + 30¢ for credit card payments and 1% for bank transfers. You can also upgrade to Wave Plus for $20/month or Wave Pro for $35/month to get additional features like bookkeeping services, payroll services, tax services, or dedicated account managers.

Overall Impression

Wave Invoicing Software is a great option for freelancers and small businesses who need a simple and affordable way to create and send invoices. It has a lot of features that make invoicing easy and convenient. However, it also has some limitations that might not suit everyone’s needs. If you are looking for more advanced features or integrations, or if you operate in a country that is not supported by Wave, you might want to look for other alternatives.

QuickBooks Online

QuickBooks Online is one of the most popular cloud-based accounting software for small and medium-sized businesses. It offers a range of features to help you manage your income, expenses, invoices, payments, taxes, reports and more. But is it the best option for your business? Here are some of the key features, pros and cons, pricing and overall impression of QuickBooks Online.

Key Features:

- QuickBooks Online lets you access your accounting data from any device with an internet connection. You can also use the mobile app to track mileage, capture receipts, send invoices and more.

- QuickBooks Online integrates with over 800 third-party apps, such as Shopify, PayPal, Stripe, Square, Mailchimp and more. You can also connect your bank and credit card accounts to automatically import and categorize transactions.

- QuickBooks Online has a variety of plans to suit different business needs. You can choose from Simple Start, Essentials, Plus or Advanced. Each plan offers different features, such as inventory tracking, project profitability, time tracking, bill management and more.

- QuickBooks Online has a powerful reporting feature that lets you customize and generate reports on your financial performance, cash flow, sales, expenses, taxes and more. You can also export your reports to Excel or PDF formats.

- QuickBooks Online has a dedicated support team that is available 24/7 via phone, chat or email. You can also access the online community, help center and video tutorials for additional guidance.

Pros:

- QuickBooks Online is easy to use and set up. You can get started in minutes and navigate the intuitive dashboard and menus.

- QuickBooks Online is scalable and flexible. You can upgrade or downgrade your plan at any time and add or remove users as needed.

- QuickBooks Online is secure and reliable. Your data is encrypted and backed up in the cloud. You can also set up permissions and roles to control who can access your data.

- QuickBooks Online is updated regularly with new features and improvements. You can also benefit from the latest tax laws and regulations.

Cons:

- QuickBooks Online can be expensive compared to some of its competitors. The plans range from $25 to $180 per month, plus $10 per user per month. You may also need to pay extra for some add-ons and integrations.

- QuickBooks Online can be slow and buggy at times. Some users have reported issues with loading times, syncing errors, duplicate transactions and more.

- QuickBooks Online can be overwhelming for some users. There are many features and options to choose from, which can make it hard to find what you need or customize it to your preferences.

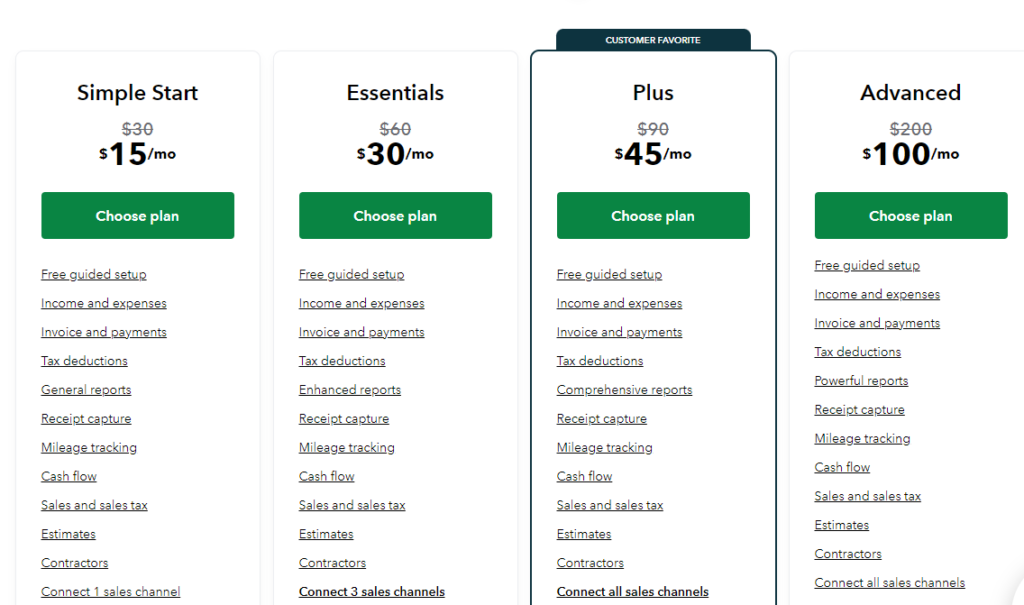

Pricing:

QuickBooks Online offers four plans: Simple Start ($15/month), Essentials ($30/month), Plus ($45/month) and Advanced ($100/month). Each plan includes one user, unlimited invoices and estimates, income and expense tracking, sales tax tracking, receipt capture and mileage tracking. You can add more users for $10 per user per month.

The main differences between the plans are:

- Simple Start: Suitable for freelancers and sole proprietors who need basic accounting features.

- Essentials: Suitable for small businesses who need more features such as bill management, time tracking and multiple currencies.

- Plus: Suitable for medium-sized businesses who need more features such as inventory tracking, project profitability and budgeting.

- Advanced: Suitable for large businesses who need more features such as custom fields, workflows, batch invoicing and dedicated account manager.

You can try any plan for free for 30 days. You can also save up to 50% off if you sign up for an annual subscription.

Overall Impression:

QuickBooks Online is a powerful and versatile accounting software that can help you manage your business finances with ease. It has a lot of features and integrations that can streamline your workflows and automate your tasks. However, it can also be pricey, complex and glitchy at times. Therefore, you should weigh the pros and cons carefully before deciding if it is worth it for your business.

Xero

If you are looking for a cloud-based invoicing software that can help you manage your cash flow, track your expenses, and send professional invoices to your clients, you might want to consider Xero. Xero is one of the most popular invoicing software in the market, with over 2 million subscribers worldwide. In this post, I will review some of the key features, pros and cons, pricing and overall impression of Xero invoicing software.

Key Features

Xero offers a range of features that can help you streamline your invoicing process and save time and money. Some of the key features are:

- Customizable invoice templates: You can choose from a variety of invoice templates that suit your brand and business needs. You can also add your logo, payment terms, discounts, and other details to your invoices.

- Online payment options: You can accept payments from your clients via credit card, PayPal, Stripe, or other online payment methods. You can also set up automatic reminders and late fees to encourage timely payments.

- Invoice tracking and reporting: You can track the status of your invoices, such as sent, viewed, paid, or overdue. You can also generate reports on your invoice performance, such as revenue, outstanding balances, payment trends, and more.

- Expense management: You can easily record and categorize your expenses, such as travel, supplies, utilities, etc. You can also attach receipts and bills to your expenses and claim them as tax deductions.

- Integration with other apps: You can integrate Xero with over 800 apps that can enhance your invoicing workflow, such as CRM, inventory, project management, accounting, and more.

Pros

- Easy to use: Xero has a user-friendly interface that is intuitive and easy to navigate. You can access your invoices from any device, anywhere, anytime.

- Affordable: Xero has a flexible pricing plan that starts from $11 per month for up to 20 invoices. You can also try Xero for free for 30 days before committing to a subscription.

- Secure: Xero uses encryption and multiple layers of security to protect your data and transactions. You can also set up permissions and roles for different users in your team.

- Support: Xero provides 24/7 customer support via phone, email, chat, or social media. You can also access online resources such as tutorials, webinars, blogs, and forums.

cons

- Limited customization: Xero has a limited number of invoice templates that you can customize. You might need to use a third-party app or service if you want more advanced customization options.

- Limited offline access: Xero is a cloud-based software that requires an internet connection to function. You might not be able to access or edit your invoices if you are offline or have a poor connection.

- Additional fees: Xero charges extra fees for some features and services, such as online payment processing, payroll, bank feeds, etc. You might need to pay more than the base price depending on your usage and needs.

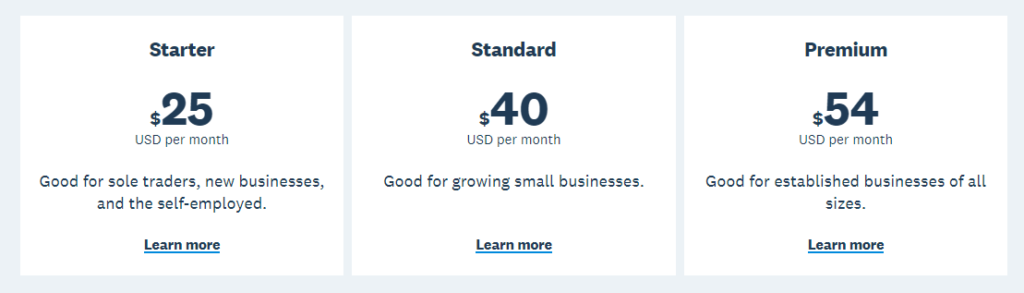

Pricing

Xero has three pricing plans that you can choose from depending on the size and nature of your business. The plans are:

- Starter: $25 per month for up to 20 invoices, 5 bills, unlimited bank reconciliations, and 1 user

- Standard: $40 per month for unlimited invoices, bills, bank reconciliations, and users

- Premium: $54 per month for unlimited invoices, bills, bank reconciliations, users, plus multi-currency accounting and payroll for up to 10 employees

You can also add extra features and services to your plan for an additional fee.

Overall Impression

Xero is a powerful and reliable invoicing software that can help you manage your cash flow and grow your business. It has a range of features that can suit different business needs and preferences. It is also easy to use, affordable, secure, and supported by a dedicated team. However, it also has some limitations that might affect your user experience and satisfaction. Therefore, I recommend that you weigh the pros and cons carefully before deciding if Xero is the right invoicing software for you.

Sage Intacct

If you are looking for a cloud-based invoicing software that can handle complex billing scenarios, Intacct might be the right choice for you. Intacct is a powerful and flexible software that can automate your invoicing process, streamline your workflows, and integrate with other systems. Here are some of the key features, pros and cons, pricing and overall impression of Intacct invoicing software.

Key Features:

- Intacct supports multiple billing models, such as subscription, usage-based, milestone, project-based, and more. You can create custom invoices with your own branding, terms, and conditions.

- Intacct allows you to track and manage your receivables, collections, and payments in real time. You can also set up automated reminders, late fees, and discounts to improve your cash flow.

- Intacct integrates with other applications, such as CRM, ERP, payroll, and accounting software. You can sync your data across different systems and eliminate manual data entry and errors.

- Intacct provides you with comprehensive reports and dashboards that show you the performance of your invoicing process. You can also create custom reports and analytics to gain deeper insights into your business.

Pros:

- Intacct is a scalable and secure software that can handle large volumes of transactions and data. It is compliant with various standards and regulations, such as GAAP, IFRS, PCI DSS, SOC 1, and SOC 2.

- Intacct is a user-friendly and customizable software that allows you to tailor it to your specific needs and preferences. You can configure your workflows, rules, templates, fields, and more.

- Intacct offers excellent customer support and training options. You can access online help, videos, webinars, forums, and knowledge base. You can also contact the support team via phone, email, or chat.

Cons:

- Intacct is a relatively expensive software compared to some of its competitors. The pricing depends on the number of users, modules, transactions, and features you need. You may also need to pay extra for implementation, integration, and customization services.

- Intacct may have a steep learning curve for some users who are not familiar with its interface and functionality. You may need to invest some time and resources to get the most out of it.

- Intacct may not have all the features or integrations that you need for your specific business scenario. You may need to use third-party add-ons or custom solutions to fill the gaps.

Pricing:

Intacct does not disclose its pricing on its website. You need to contact the sales team for a quote based on your requirements. However, according to some online sources, the average price range of Intacct is between $400 and $800 per user per month.

Overall Impression:

Intacct is a robust and versatile invoicing software that can handle complex billing scenarios and integrate with other systems. It is suitable for medium to large businesses that need a high level of automation, flexibility, and security. However, it is also a costly and complex software that may require some training and customization to fit your needs.

—–

Disclosure: Please note that we may receive affiliate compensation for some of the links below, at no expense to you, should you decide to purchase a paid plan. This blog does not provide financial advice, it is purely for entertainment and fun.