Cryptocurrencies are gaining unimaginable popularity all over the world. A wide array of demographics has been proven meddling with cryptocurrencies, from meager to hefty amounts. As volatile as it is, the more tech-savvy people find digital trading enjoyable and profitable. But if you’re a cryptocurrency neophyte, learning the ropes and consulting the experts are the best bets before jumping into this risky investment.

Another facet of cryptocurrency that’s also making waves in the market is crypto-backed quick loans. Although this is considered a new innovation, some people see it as a great way to leverage their cryptocurrency investments while some people say borrowing from a crypto-backed quick loan is completely ridiculous.

The populace is divided. But only one fact remains – crypto-backed quick loans will definitely have a huge impact on the crypto industry.

How Do Crypto-Backed Quick Loans Work?

When borrowing from crypto loans, you eliminate the middleman during the transaction process such as banks and other financial institutions. In other words, it’s not a conventional type of borrowing money. Some of these loans offer better rates than bank interest rates. Say, for example, you have crypto assets, in most cases, a crypto holder sells their crypto when the time is good for selling to gain profits. However, some investors use their cryptocurrencies as collateral when borrowing from a crypto quick loan, allowing them to still manage ownership of their funds and getting some cash at the same time for whatever purpose it serves.

Some people say it’s completely mad to borrow from a crypto loan because it’s a very capricious business. Prices can fluctuate and drop anytime. A borrowed cash of a thousand dollars can make you end up paying off double or triple the borrowed amount if you get caught in the price drop frenzy.

If you ever want to buy a new home, diversify investments, pay off travel expenses, settle your long overdue debts, or fund a business; crypto quick loans are an excellent way to start getting cash. It’s very fast, easy, and hassle-free.

The initial step when borrowing is of course – assessment. A borrower is evaluated based on his credit score, demographic data, and online activities to assess if the borrower is eligible for a loan and is trustworthy of paying it off.

The Impact on the Crypto Industry

Now that you know the ins and outs of crypto-backed quick loans, it’s time to scrutinize how this effective innovation will change the entire crypto industry.

First of all, cryptocurrency will be more popular than ever. It’ll entice more investors in joining the bandwagon. We all know how cryptocurrency sometimes gets a bad rap for its volatility but with crypto-backed loans, people will assume that this is a progressive and positive industry which is worth taking a risk for.

Secondly, because the entire borrowing process is quite easy to accomplish, more and more people will opt for borrowing crypto loans instead of borrowing from conventional lending institutions. Although most crypto loans strictly do credit checks on borrowers, there are some crypto loans out there which don’t adhere to this initial step. It’s very convenient for people who are struggling with their credit history. Consequently, the industry will become a top choice for loaning money and cryptocurrencies will gain more trust from people. In the future, we can expect these crypto platforms to multiply in number and there will be an influx of investors as well. The crypto world will be a topnotch investment caliber in digital trading.

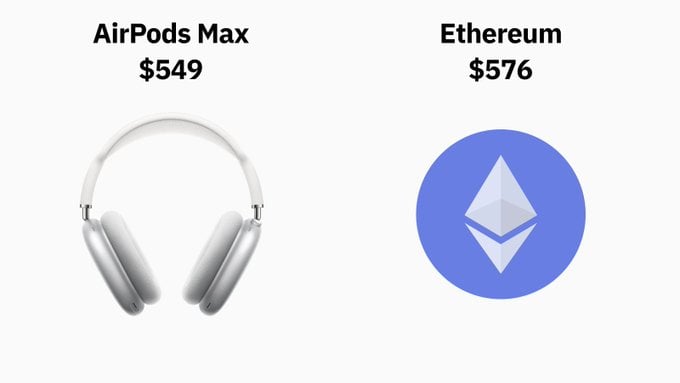

Thirdly, as more and more people enter into the world of digital currencies, we can expect an increase in digital coin prices. The value of these digital coins will see a price surge because there will be a higher demand in the future.

Lastly, all preconceived notions about cryptocurrencies being a negative way to achieve profitability will be completely eliminated. The crypto world will become a force to be reckoned with.

Is It Worth Borrowing from A Crypto-Backed Quick Loan?

As previously mentioned, you could end up paying triple the borrowed amount because cryptocurrencies are extremely volatile. True enough, it has been proven to be a risky digital trading. While some people advice that if you need instant cash, all you have to do is sell your coins and that’s it. But because the crypto industry wants the best for their investors in terms of convenience, crypto holders can now use their cryptocurrencies as collateral when borrowing from quick loans without having to sell their crypto. Then they can pay off their loan and get all of their crypto back.

There’s a reason why the crypto world has opened up this new facet in the middle of its booming digital situation. And that’s because they see this as a better option of getting instant cash while avoiding endless queues and a bunch of red tape during the entire process in traditional lending companies. So I guess you could say – YES, borrowing from crypto-backed quick loans are worth it.

————————-

Author Bio:Lily, is a blogger, who enjoys sharing tips on personal finance, business and entrepreneurship. She is currently working for My Quick Loans, which offers fast loans online in the UK including Christmas loans, Payday loans, Late Night loans, Weekday loans, Student Short Term Payday loans and many more.